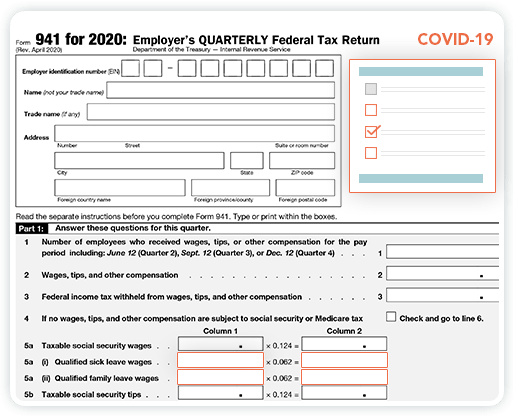

Form 941-X for 2020

Adjusted Employer's QUARTERLY Federal Tax Return or Claim for Refund

E-File 941-X NowComplete Guide on IRS Form 941-X

Updated on July 17, 2020 - 10:30 AM by Admin, ExpressEfile Team

Have you discovered errors on previous filed Form 941 tax returns? No worries! Form 941-X is here to make corrections to the filed Form 941.

Refer to the below topics to learn more amount Form 941-X:

1. What is Form 941-X?

IRS Form 941-X, Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund Form, can be used to make corrections to Form 941. If you have figured out the errors on your previously filed Form 941, you should use Form 941-X to correct those errors.

Note: You need to file separate Form 941-X for each Form 941 that you want to correct.

You have to file Form 941-X with the following details.

- Underreported taxes - Reported less amount than the exact amount

- Overreported taxes - Reported more amount than the correct amount

You have to make a tax payment while filing Form 941-X if it is for underreported taxes. While you report overreported taxes using Form 941-x, you can either claim a refund or adjustment for the next tax return.

2. When to use Form 941-X?

You can file Form 941-X if any of the following amounts are misreported on your previously submitted Form 941.

- Wages, tips, and other compensation

- Income tax withheld from employee's paycheck and extra compensation

- Taxable social security wages

- Taxable social security tips

- Taxable Medicare wages and tips

- Taxable wages and tips subject to Additional Medicare Tax withholding

- Qualified small business payroll tax credit for increasing research activities

If you have reported the incorrect number of employees who received wages or Part 2 of Form 941, there is no need for filing Form 941-X.

3. Types of errors that you can correct using Form 941-X

The following errors can be corrected using the Form 941-X:

- Underreported amounts ONLY

- Overreported amounts ONLY

- Both underreported and overreported amounts

4. What is the deadline for filing Form 941-X?

No specific deadline is stated by the IRS to file Form 941-X. However, it must be filed at the time when you discover the errors made on your prior Form 941. There is a time frame for reporting the overreported and underreported amounts. This time frame is called "period of limitations".

As per the period of limitations, Form 941 for the calendar year is considered to be submitted on April 15 of the succeeding year, even if filed before that date.

You can correct the over reported taxes on your previously filed Form 941 using Form 941-X within three years from the date you filed Form 941, or two years from the date you paid the tax reported on Form 941.

You can correct the underreported taxes using Form 941-X within three years from the date Form 941 was actually filed.

5. Is there any penalty for underreporting taxes?

There is no penalty or interest for correcting unreported amount if you do the following:

- File on time

- Pay the amount that is shown on Line 20 when you file Form 941-X

- Mention the date when you found the error

- Clearly explain your corrections You are subjected to pay interest if the following applies to you:

- The underreported tax is related to the calculation of a prior period

- You deliberately underreported taxes

- You received a notice and payment demand from IRS

- You got a Notice of Determination of Worker Classification

Note: If you get this notice even after you file Form 941-X, you can reply with a valid explanation.

6. Mailing Address of Form 941-X

Form 941 X mailing address entirely depends on your business location. Have a look at the below section and know where you have to mail your Form 941-X.

| If you are in: | Mailing Address |

|---|---|

Connecticut, Delaware, District of Columbia, Florida, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, or Wisconsin |

Department of the Treasury, |

Alabama, Alaska, Arizona, Arkansas, California, Colorado, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, or Wyoming |

Department of the Treasury, |

No legal residence or principal place of business in any state: |

Internal Revenue Service, |

There is a special filing address for exempt organizations; federal/state/local government entities, and Indian tribal governmental entities, regardless of location: |

Department of the Treasury, |

E-File Form 941 with ExpressEfile

ExpressEfile lets you E-file Form 941 easily and quickly. It takes only a few minutes to E-File your 941 directly with the IRS.

ExpressEfile offers the lowest price of $3.99 for filing Form 941.

E-File 941-X Now