IRS Form 941 Instructions

Updated on July 17, 2020 - 10:30 AM by Admin, ExpressEfile

Form 941 is an employer’s quarterly tax form that is filed by employers to report federal income tax withholdings from employees. The calculation of these taxes and filing of this return can be quite confusing. You can take a look at these line-by-line instructions, to get a better understanding of how to file your

Form 941 return.

In this article, we cover the following topics:

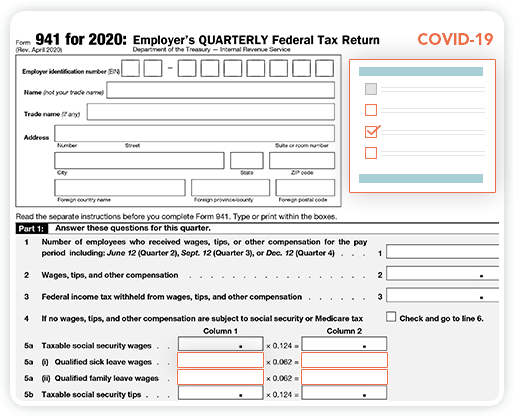

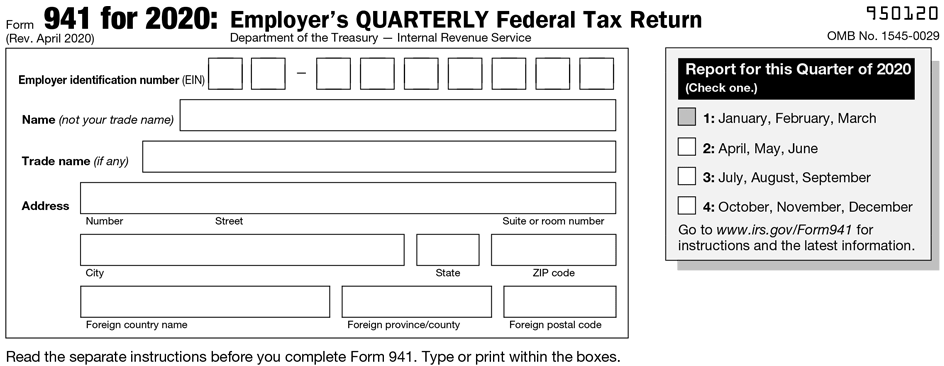

1. Complete Business Information

The first step in filing your Form 941 return is to enter basic information about your business. Provide the basic details in the following boxes.

Box 1 - Employer Information

Enter basic information about your business like Employer Identification Number (EIN), business name, and business address.

Box 2 - Choose the filing quarter

Choose the correct quarter for which you are filing your Form 941 return. For example, if you’re filing for the second quarter, check the box next to “April, May, June”.

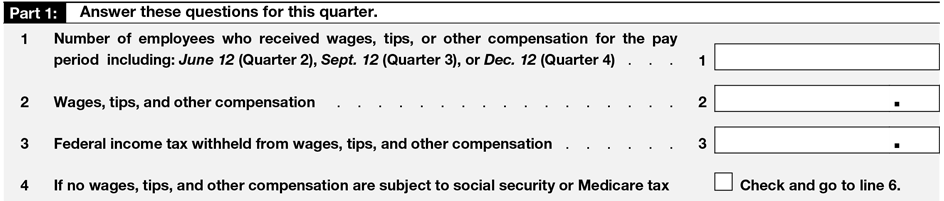

1. Part 1 - Wages, Social security and Medicare, Wage limit

This part of the return involves reporting information about employees, their wages, and the federal income taxes withheld from their paychecks during the quarter.

-

Line 1:

Enter the number of employees, who received wages, tips, or other payments in the quarter.

-

Line 2:

Enter the total amount of wages, tips, and other payments paid to the employees in the quarter.

-

Line 3:

Enter the total amount of federal tax withheld from the employees’ paychecks.

-

Line 4: CheckBox

If the wages aren’t subjected to any social security or medicare taxes, check this box. Skip this line if these taxes apply.

-

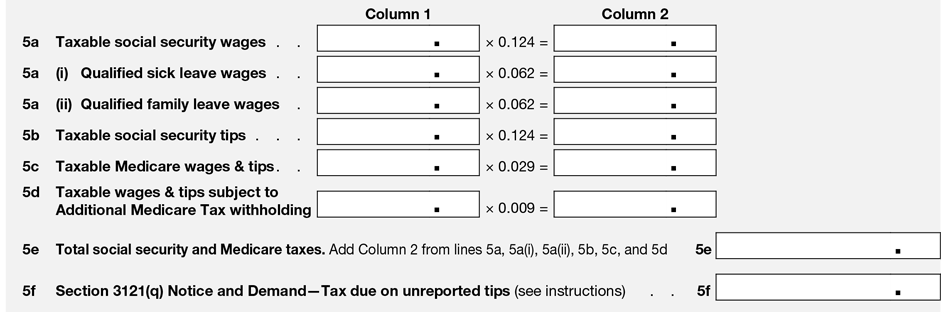

Line 5a: Taxable social security wages

The amount entered in this line should be equal to the sum of the amount entered in Line 5a(i) and Line 5a(ii).

- 5a(i) - The total amount of qualified sick-leave wages. (Not part of the original form. Included due to COVID-19 changes)

- 5a(ii) - The total amount of qualified family-leave wages. (Not part of the original form. Included due to COVID-19 changes)

-

Line 5b:

Enter the total amount of taxable security tips paid to all employees.

-

Line 5c:

Enter the total amount of taxable wages, and tips, that are subject to Medicare tax.

-

Line 5d:

Enter the total amount of taxable wages & tips subject to Additional Medicare Tax withholding.

-

Line 5e:

This line should contain the sum of values from column 2 of lines 5a,5b,5c, and 5d.

-

Line 5f:

Enter the total tax due received from Section 3121(q) Notice and Demand.

-

Section 3121(q) Notice and Demand:

This is issued by the IRS to advise the employers to report the tips that the employees haven’t reported. The employers aren’t required to report this information until they receive this notice.

-

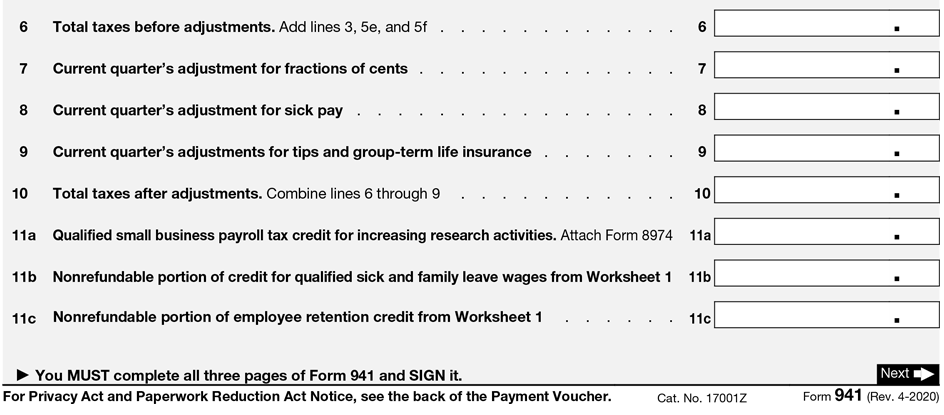

Line 6: Total taxes before adjustments

The value entered in this line should be a sum of lines 3, 5e, and 5f.

-

Line 7:

Enter the adjustment for a fraction of cents.

-

Line 8:

Enter the adjustment for sick pay.

-

Line 9:

Enter the adjustments for tips and group-terms life insurance.

-

Line 10:

Enter the total tax after the adjustments. Add the values from lines 6,7,8, and 9.

-

Line 11a: Qualified small business payroll tax credit for increasing research activities

Enter the amount calculated in Form 8874.

-

Form 8874:

This form is used to calculate the amount of credit that can be claimed for the increasing research activities.

-

Line 11b:

(Not part of the original form. Included due to COVID-19 changes)

Enter the non-refundable amount of credit for qualified sick and family wages. -

Line 11c:

(Not part of the original form. Included due to COVID-19 changes)

Enter the non-refundable amount of employee retention credit.

-

Line 11d:

Enter the total amount of non-refundable credits. Add lines 11a,11b, and 11c.

-

Line 12:

Enter the total taxes after the adjustments and credits. Subtract line 11d from line 10.

-

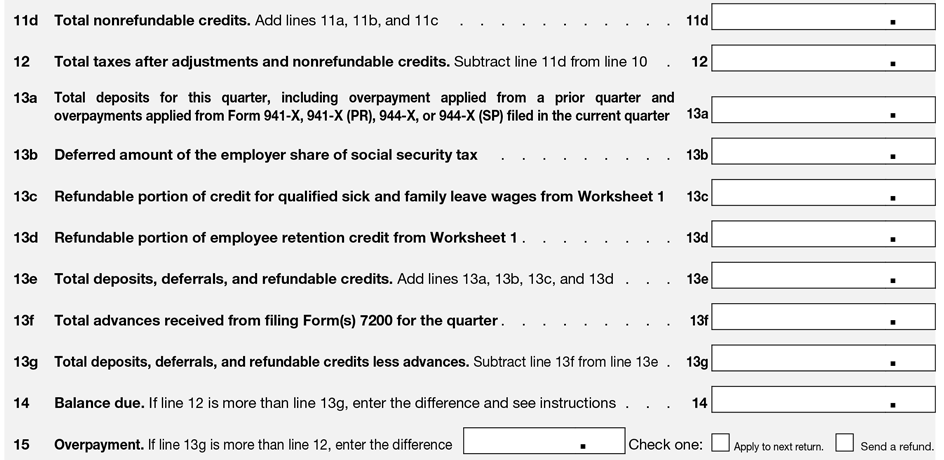

Line 13a:

Enter the total amount of deposits for the quarter. This should include overpayment applied from previous quarters and Form 941-X for the current quarter.

-

Line 13b:

(Not part of the original form. Included due to COVID-19 changes)

Enter the deferred amount of the employee’s share of Social Security Tax. -

Line 13c:

(Not part of the original form. Included due to COVID-19 changes)

Enter the refundable amount of credit from the qualified sick-leave and family-leave wages. -

Line 13d:

(Not part of the original form. Included due to COVID-19 changes)

Enter the refundable amount of credit from the employee retention credit. -

Line 13e:

(Not part of the original form. Included due to COVID-19 changes)

Enter the total amount of refundable credits. Add lines 13a,13b,13c, and 13d. -

Line 13f:

(Not part of the original form. Included due to COVID-19 changes)

Enter the total amount of advances received from filing Form 7200. -

Line 13g:

(Not part of the original form. Included due to COVID-19 changes)

Enter the total amount of deposits, deferrals, and refundable credits less advances. Subtract line 13f from line 13e. -

Line 14:

Enter the difference if line 12 is more than line 13g. You must pay the balance due.

-

Line 15:

Enter the difference if line 13g is more than line 12. You can claim the credit amount.

CheckBox - Apply the credits to pay taxes for the next return, or receive a refund.

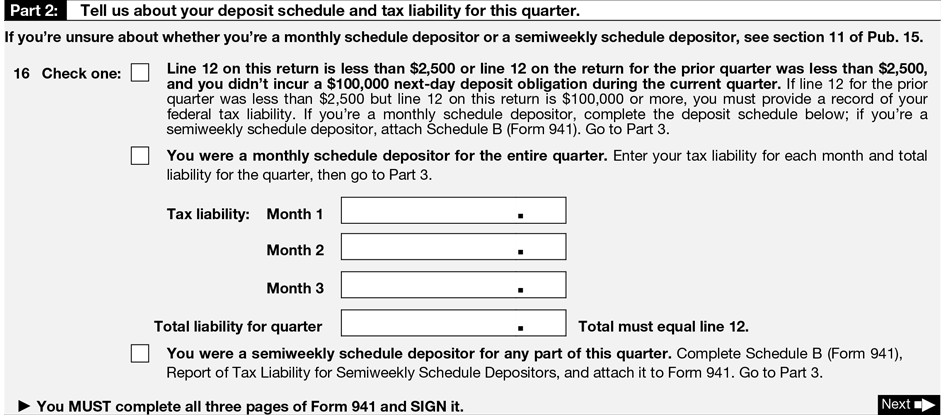

3. Part 2 - Deposit schedule and tax liability for the quarter

This part requires you to enter information about the tax liability and the time of deposit.

-

Line 16: CheckBox

Check the appropriate box based on your tax liability. Check the boxes if it passes the following conditions.

CheckBox 1

- If the value on line 12 is less than $2500.

- If the value on line 12 was less than $2500 for the previous quarter.

- If you didn’t incur a next-day deposit obligation of $100,000 for the current quarter.

CheckBox 2

If you’re a monthly schedule depositor for the quarter. You need to enter the value of tax liability for each month during the quarter. Your total liability for the quarter should be the same as the value on line 12.

CheckBox 3

If you’re a semiweekly schedule depositor for the quarter. Enter the tax liability on Schedule B and attach it along with your Form 941.

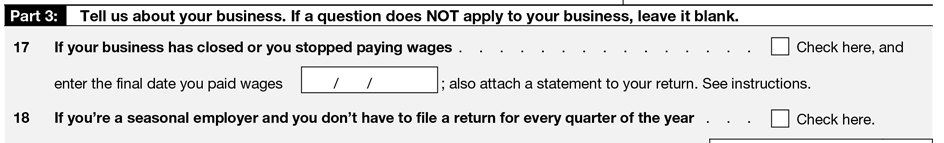

4. Part 3 - About your business

This section is used to provide information about your business.

-

Line 17: CheckBox

Check this box if your business was closed or didn’t pay any wages for the whole quarter. If you check this box, enter the date on which the wages were finally paid.

-

Line 18: CheckBox

Check this box if you’re a seasonal employer, and you aren’t required to file Form 941 for every quarter.

-

Line 19:

(Not part of the original form. Included due to COVID-19 changes)

Enter the total amount of qualified health plan expenses, allocable to sick-leave wages. -

Line 20:

(Not part of the original form. Included due to COVID-19 changes)

Enter the total amount of qualified health plan expenses, allocable to family-leave wages. -

Line 21:

(Not part of the original form. Included due to COVID-19 changes)

Enter the total amount of qualified wages for the employee retention credit. -

Line 22:

(Not part of the original form. Included due to COVID-19 changes)

Enter the total amount of qualified health plan expenses, allocable to wages reported for employee retention credit. -

Line 23:

(Not part of the original form. Included due to COVID-19 changes)

Enter the credit from Line 11 of Form 8554-C for this quarter. Skip this line if you aren’t required to file Form 8554-C. -

Line 24:

(Not part of the original form. Included due to COVID-19 changes) (Only for 2nd quarter)

Enter the total amount of qualified wages paid from March 13, 2020, to March 31, 2020, for employee retention credit. -

Line 25:

(Not part of the original form. Included due to COVID-19 changes) (Only for 2nd quarter)

Enter the total amount of qualified health plan expenses, allocable to wages reported on line 24.

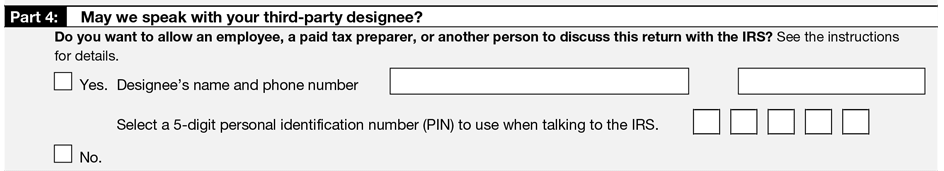

5. Part 4 - Third Party Designee - CheckBox

Check this box if you decide to discuss your Form 941 return with the IRS.

If you choose yes - Enter the designee’s name and phone number. Provide any 5 digit PIN, which should be used while talking to the IRS.

If you choose no - Skip this section.

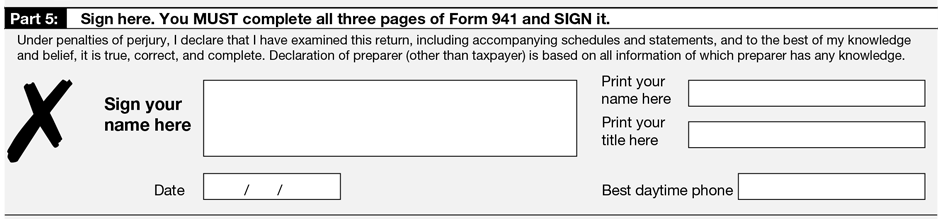

6. Part 5 - Signature

After the completion of all the parts in Form 941, you are required to sign the form before transmitting it to the IRS. Here are the signing authorities for each type of companies:

- Sole proprietorship: Individual who owns the company

- Corporation or an LLC treated as a corporation: President, vice president, or other principal officer

- Partnership or an LLC treated as a partnership: Partner, member, or officerCheck or Money Order

- Single-member LLC: Owner of the LLC or a principal officer

- Trust or estate: The fiduciary

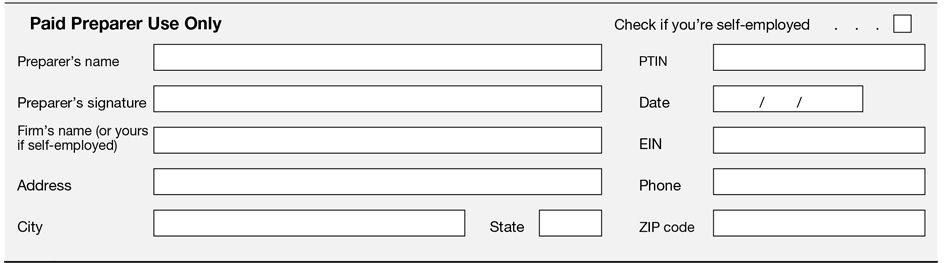

- Paid Preparers - Tax preparers must have filed a valid power of attorney form, to file Form 941 on behalf of a client. The paid preparer must provide his name, address, phone number, signature, and PTIN.

Form 941 has been revised for quarters 3 & 4 by the IRS to accommodate the relief measures passed by the federal government to overcome the COVID-19 pandemic.

E-File Form 941 with ExpressEfile

ExpressEfile lets you E-file Form 941 easily and quickly. It takes only a few minutes to E-File your 941 directly with the IRS.

ExpressEfile offers the lowest price of $3.99 for filing Form 941.

E-File 941 Now