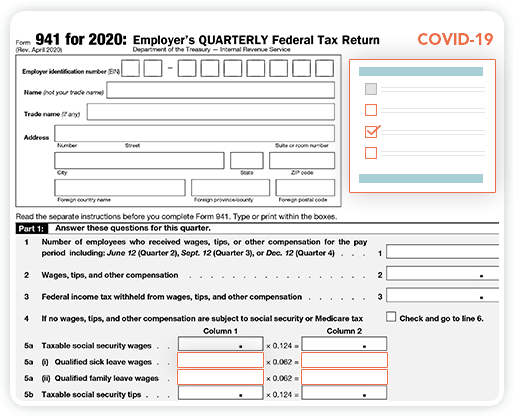

Form 941 Schedule B for 2020

Step by Step instructions for the IRS Form 941 Schedule B.

E-File 941 Now!Overview of IRS Form 941 Schedule B

Updated on July 17, 2020 - 10:30 AM by Admin, ExpressEfile

The employers must withhold federal income tax, social security tax, and Medicare tax from employee's paycheck and should be reported to the IRS. Generally, semiweekly schedule depositors should use Schedule B if they have reported the payroll taxes more than $50,000. The employers who accumulate more than $100,000 in tax liabilities on any single day in the tax year should also file Schedule B along with Form 941. Read on to know more about

941 Schedule B 2020.

1. What is Form 941 Schedule B?

Schedule B should be filed with Form 941 to report the federal income taxes withheld from the employee's wages and employer and employee portion of social security and Medicare taxes. Every quarter the employer has to report the withholding information in Form 941 Schedule B.

Employers should not use Schedule B to show the federal tax deposit.

2. How can I know if I need to complete Schedule B for Form 941?

All employers don't need to file IRS Form 941 Schedule B. If the employers satisfy the following tax liability categories, they must file Schedule B.

Reported employment taxes more than $50,000 in the lookback period. Acquired $100,000 tax liability or more during any single day in the current or previous calendar year.

3. Why should I file Schedule B (Form 941)?

You need to complete Schedule B (Form 941) if you are a semiweekly schedule depositor. It will let the IRS know your business wages and related withholdings.

4. How can I complete Schedule B with Form 941?

You can complete Schedule by two different types as follows:

- You can file Form 941 and Schedule B electronically through IRS certified e-file providers in a few minutes.

- If you choose paper filing, complete Form 941 and Schedule B and mail it to the IRS.

5. What is the due date or deadline for filing Schedule B - Form 941?

No specific deadline is fixed for Schedule B by the IRS. However, it has to be filed with your Form 941 according to the quarterly deadline.

- Deadline for First Quarter (Jan, Feb, and Mar) - Apr 30, 2020

- Deadline for Second Quarter (Apr, May, and Jun) - Jul 31, 2020

- Deadline for Third Quarter (Jul, Aug, and Sep) - Nov 02, 2020

- Deadline for Fourth Quarter (Oct, Nov, and Dec) - Jan 31, 2021

6. Is there any penalty if Schedule B (Form 941) is not filed?

If you have failed to file Schedule B, the IRS will not be able to calculate the exact penalty rates. Thus, the IRS will impose an average FTD penalty. It will be calculated based on the total tax liability reported in Form 941, line 12.

Form 941 has been revised for quarter 2 and quarters 3 & 4 by the IRS to accommodate the relief measures passed by the federal government to overcome the COVID-19 pandemic.

E-File Form 941 with ExpressEfile

ExpressEfile lets you E-file Form 941 easily and quickly. It takes only a few minutes to E-File your 941 directly with the IRS.

ExpressEfile offers the lowest price of $3.99 for filing Form 941.

E-File 941 Now