Changes in Form 941-X for 2020

Updated on September 18, 2020 - 10:30 AM by Admin,

ExpressEfile Team

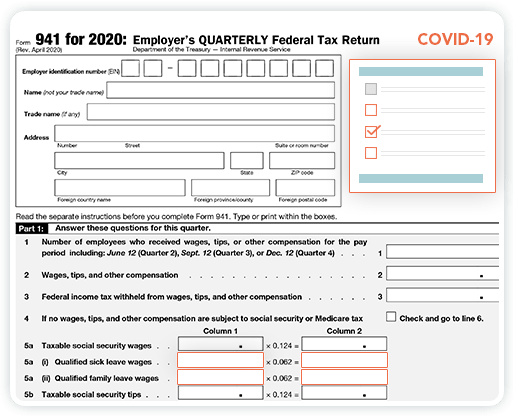

With continuous changes to Form 941 due to the COVID-19 pandemic, the IRS has revised Form 941-X for quarter 2. This revision is made to accommodate filing corrections for values reported on Form 941, quarter 2, 2020.

Read on to learn more about revised Form 941-X for quarter

2, 2020:

1. Form 941-X - A Quick Overview

If you have filed Form 941 for a quarter and found errors on your return, you have to correct the values reported by filing Form 941-X, Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund Form. In case you found errors in more than one quarter, you may have to file separate Form 941-X for each quarter.

To learn more about Form 941-X including its deadline, penalty, and mailing address,

click here.

2. What Should be Reported in Form 941-X?

You can file Form 941-X if any of the following values are misreported on your previously submitted Form 941:

- Wages, tips, and other compensation

- Federal income tax withheld from employee's paycheck and extra compensation

- Taxable social security wages

- Taxable social security tips

- Taxable Medicare wages and tips

- Taxable wages and tips subject to Additional Medicare Tax withholding

- Qualified small business payroll tax credit for increasing research activities

Note: In case, you have misreported the total number of employees who received wages or Part 2 of Form 941, you need not file Form 941-X.

3. What’s New in Form 941-X for Q2?

Employers can now file Form 941-X for correction in values reported in Form 941 in the following fields:

- Credit for qualified sick and family leave wages

- Employee retention credit

- Employer share of social security

Below are the changes in Form 941-X and their respective fields in Form 941:

| If you’ve misreported | In Form 941 | Report corrections in Form 941-X |

|---|---|---|

| Qualified sick and family leave wages | ||

Qualified sick-leave wages |

Line 5(i) |

Line 9 |

Qualified family-leave wages |

Line 5a(ii) |

Line 10 |

Non Refundable portion of credit for qualified sick- and family-leave wages |

Line 11b |

Line 17 |

Refundable portion of credit for qualified sick- and family-leave wages |

Line 13c |

Line 25 |

Qualified health plan expenses allocable to qualified sick-leave wages |

Line 19 |

Line 28 |

Qualified health plan expenses allocable to qualified family-leave wages |

Line 20 |

Line 29 |

| Employee retention credit | ||

Non Refundable portion of employee retention credit |

Line 11c |

Line 18 |

Refundable portion of employee retention credit |

Line 13d |

Line 26 |

Qualified wages for the employee retention credit |

Line 21 |

Line 30 |

Qualified health plan wages reported on Form 941, Line 21 |

Line 22 |

Line 31 |

Qualified wages paid March 13 to March 31, 2020, for the employee retention credit |

Line 24 |

Line 33 |

Qualified health plan expenses allocable to wages reported of Form 941, Line 24 credit |

Line 25 |

Line 34 |

Deferred amount of the employer share of Social Security tax |

Line 13b |

Line 24 |

4. Which Form should You File?

If you’re correcting values reported in Form 941 for quarter 1, 2020, and prior, you can use the existing Form 941-X

In case, you want to file corrections for quarter 2, 2020, Form 941, you must use the revised Form 941-X.

5. Complete and Download Form 941-X for FREE

With ExpressEfile, you can complete Form 941-X with quarter 2 changes, download it for free, and file it with the IRS.

Complete Form 941-X Now