Mailing Address for the IRS Form 941

Updated on September 22, 2020 - 10:30 AM by Admin,

ExpressEfile Team

Paper filing your Form 941 return is a complicated process than it seems to be. Take a look at the following topics to get a comprehensive understanding of the things you need to know before paper filing a Form 941 return. There is also a set of instructions provided on how and where to mail your

Form 941 return.

Table of Contents

1. Mailing Address for Form 941?

If you decide to paper file your Form 941 return, you must mail a copy of the return to the IRS. The mailing address of your Form 941 return depends on the state in which your business operates and the inclusion of payment along with your Form 941 return.

E-filing your Form 941 return results in much quicker processing by the IRS, which increases the chances of instant approval of your return by the IRS. You can

e-file your Form 941 return and also pay your tax dues using ExpressEfile.

Make sure to attach a generated payment voucher along with your payment amount to the correct mailing address, if you choose a check or money order as your payment option.

| IF you’re in ... | Mail return without payment ... | Mail return with payment ... |

|---|---|---|

Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, Wisconsin |

Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0005 |

Internal Revenue Service PO Box 806532 Cincinnati, OH 45280-6532 |

Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, Wyoming |

Department of the Treasury Internal Revenue Service Ogden, UT 84201-0005 |

Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 |

No legal residence or principal place of business in any state: |

Internal Revenue Service PO Box 409101 Ogden, UT 84409 |

Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 |

Special filing address for exempt organizations; governmental entities; and Indian tribal governmental entities; regardless of location |

Department of the Treasury Internal Revenue Service Ogden, UT 84201-0005 |

Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 |

Please visit IRS.gov/PDSstreetAddresses if you’re using a Private Delivery Service (PDS). The mailing address will be the same as the address for "return without payment" for your business's state, as mentioned in the above table.

2. Form 941 Filing Deadline?

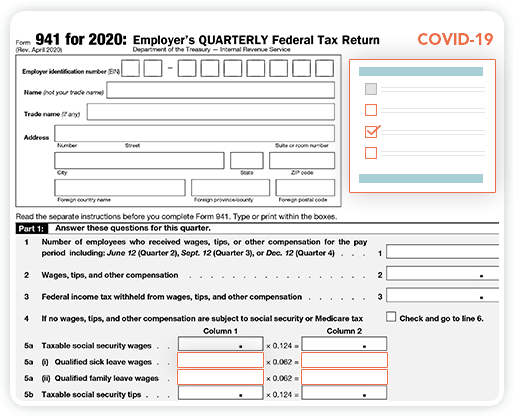

Form 941 is a federal IRS tax return, filed by employers to report federal income taxes withheld from employee's wages, and employee and employer share of social security taxes and Medicare (FICA) taxes on a quarterly basis.

The deadline to file your Form 941 is the last day of the month following the end of the quarter. The deadline for each quarter is as follows.

1st Quarter

2nd Quarter

3rd Quarter

4th Quarter

Form 941 has been revised for quarter 2 and quarters 3 & 4 by the IRS to accommodate the relief measures passed by the federal government to overcome the COVID-19 pandemic.

3. Form 941 filing methods?

The IRS recommends the users to e-file Form 941 return as it is easier. The e-file method not only makes the filing process quicker but also gets your return status instantly. The employers will find it simpler to file their Form 941 returns and pay their tax dues.

Form 941 paper filing is a very hectic process and also costs the employers a lot of time. Unlike the e-filing method, it is tough to track the filing status of your return. Even though it seems like paper filing your Form 941 return is free of cost, you will have to spend printing your returns, envelopes, and postal mails.

E-File Form 941 with ExpressEfile

Employers can e-file Form 941 easily with ExpressEfile by following a few simple steps. Just enter the required information, review the form, and transmit it directly to the IRS. The whole process takes only a few minutes.

ExpressEfile offers the lowest price of $3.99 for filing Form 941.

E-file Form 941 Now