Due Date for the IRS Form 941 for the Tax Year 2020

Updated on September 18, 2020 - 10:30 AM by Admin, ExpressEfile Team

Form 941 is a federal tax return filed by employers in the United States, which is due every quarter. Everything you want to learn about IRS Form 941 due date is explained in this article.

1. What is Form 941?

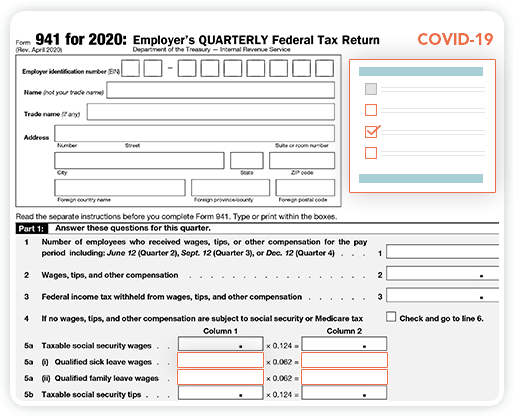

The IRS Form 941, Employer's QUARTERLY Federal Tax Return, must be filed by employers to report the federal income taxes withheld from employees, employee and employer share of social security and Medicare (FICA) taxes.

The employer should file Form 941 for every quarter. Usually, Form 941 due date falls by the last day of the month following the reporting quarter.

As an employer, you are liable to file Form 941 before the deadline regardless of whether you have tax amounts to report for a quarter or not, which means you have to e-file Form 941 with zero tax amounts.

You are exempted from filing Form 941, if

- You are a seasonal employer who has not paid any wages or tips to your employees for the reporting quarter.

- Your business is closed and filed your final return.

- You’re an agricultural employer. You have to file the annual return Form 943 with the IRS.

- You’ve been instructed by the IRS to file the annual return, Form 944.

Form 941 has been revised for quarter 2 and quarters 3 & 4 by the IRS to accommodate the relief measures passed by the federal government to overcome the COVID-19 pandemic.

Note: For each quarter, you can file only one Form 941 either by paper filing or electronically. The IRS recommends that you e-file Form 941 for easy and instant filing.

2. When is the deadline for filing Form 941?

It is essential to know the Form 941 deadline before filing to stay away from the penalties. Below is the Form 941 deadline for each quarter.

| Quarter | Reporting Period | Due Date |

|---|---|---|

Quarter 1 |

Jan, Feb, and Mar |

April 30, 2020 |

Quarter 2 |

Apr, May, and Jun |

July 31, 2020 |

Quarter 3 |

Jul, Aug, and Sep |

November 02, 2020 |

Quarter 4 |

Oct, Nov, and Dec |

February 01, 2021 |

Note: If you have deposited the taxes timely and in full, you can file the form before the 10th of the second month of your quarter’s end.

For instance, you have to report the wages you paid during the second quarter on or before July 31. If your tax deposits are on time and in full, you may file Form 941 by the 10th of the second month of the quarter’s end. In this case, you can file Form 941 before August 10 if your deposits are made timely and in full for the second quarter.

3. How to file Form 941 for the 2020 tax year?

You can file form 941 either by paper or electronically.

For electronic filing,

Electronic filing or E-filing is the easiest way to file and transmit your Form 941 to the IRS. First, you have to select an IRS-authorized e-file provider and fill out the required information to complete your Form 941. Transmit the form to the IRS on or before the IRS Form 941 due date. By doing so, you will get filing status notification instantly.

ExpressEfile is an IRS-authorized e-file provider that allows you to e-file and transmit your forms to the IRS error-free. We offer a user-friendly platform to file your 941. You can complete your filing and transmit your return with the IRS in minutes easily.

Click here to get more information on how to e-file form 941.

For paper filing,

If you want to paper file Form 941, send a copy of your form to the correct mailing address with sufficient postage and be postmarked by the U.S. Postal Service. Refer to the above Quarterly Form 941 due date section and send it on or before the deadline. You can refer appropriate 941 mailing address to send your returns.

Visit www.expressefile.com/form-941-mailing-address to get more information about Form 941 mailing addresses.

4. How to avoid IRS Form 941 late filing penalties and interest?

To stay away from Form 941 late filing penalties and interest, do the following:

E-File Form 941 with ExpressEfile

Employers can e-file Form 941 easily with ExpressEfile by following a few simple steps. Just enter the required information, review the form, and transmit it directly to the IRS. The whole process takes only a few minutes.

ExpressEfile offers the lowest price of $3.99 for filing Form 941.

E-file Form 941 Now