E-File Form 941 Online for 2020

E-File 941 Now!Complete Form 941 in less than 5 minutes.

E-File 941 for

$3.99

per return.

Lowest Price in the Industry

Simplify Form 941 Online Filing with ExpressEfile!

Lowest Price

E-File your Form 941 to the IRS directly only for $3.99/form. Even low compared to your paper filing cost.

Built-In Error Check

Our internal audit check makes sure your return is error-free to transmit with the IRS, reducing the chances of the form rejection.

IRS Instant Notification

Once the IRS processes your return, you will get instant filing status from the IRS.

Form 8974

Get everything required for your 941 filings. File 941 with Schedule B and Form 8974 if required.

Complete and File Form 941 online

Simple, Quick & Easy. It takes only less than 5 minutes.

What is the deadline to File Form 941 for 2020?

The deadline to file form 941 is due by every last day of the month following the quarter-end. File Form 941 four times for every quarter in a year.

First Quarter

April 30th,

2020

Second Quarter

July 31st,

2020

Third Quarter

November 2nd,

2020

Fourth Quarter

February 1st,

2021

Note: If the deadline comes on any federal holiday, then file form 941 on the next working business day.

Why Choose ExpressEfile to File Form 941 Electronically

IRS Authorized 941 E-file Provider

Easy to use Dashboard

Review Form Summary

Lowest Price in the industry

Accurate Calculations

Make Corrections before filings

Instant IRS Filing Status

Built-in Error Check

Download & Print Forms

How to E-File Form 941 Online with ExpressEfile

-

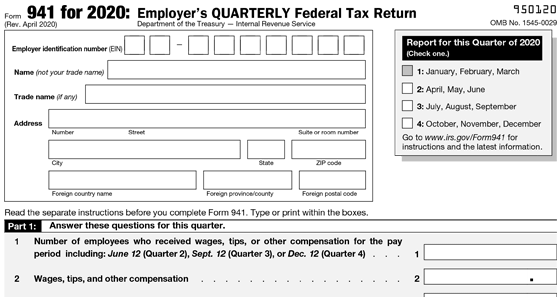

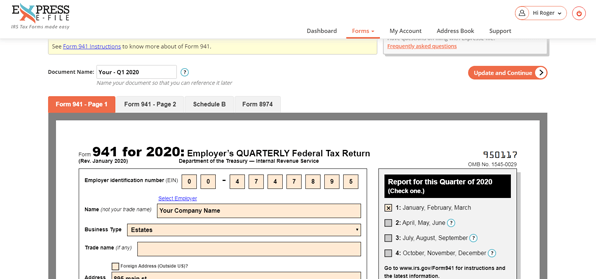

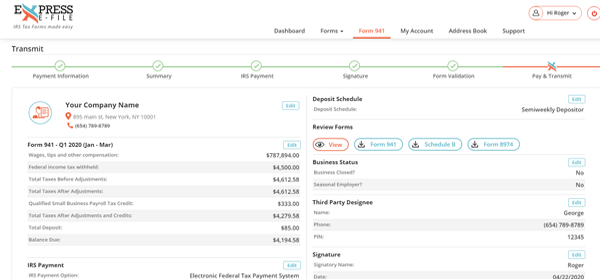

Step 1: Complete Form 941 Information

Choose Quarter and enter basic Employer information (EIN, Name, Business Name, Address)

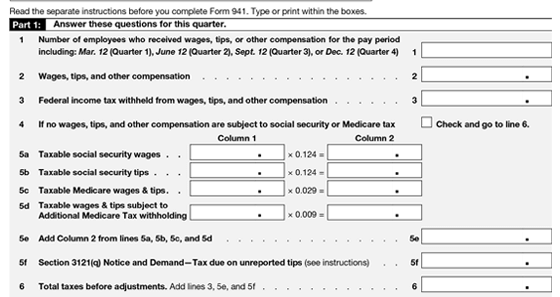

Enter employee count, wages, and taxes withheld

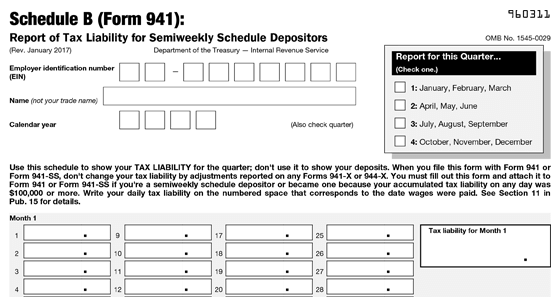

Enter the Schedule Deposit & tax Liability for the quarter

Complete Schedule B and Form 8974 if required

-

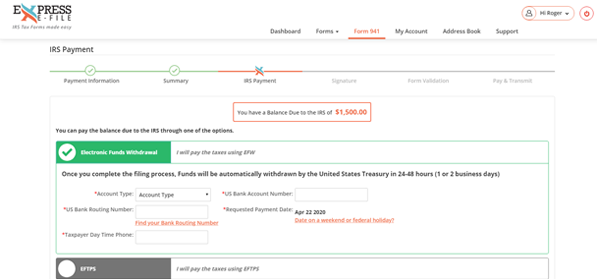

Step 2: Pay Balance Due if any

Our software will allow you to pay the balance due to the IRS using EFW, EFTPS, and check or money order. Choose the IRS Payment Option of your choice and pay your balance due

If you choose to pay using EFTPS, make sure to pay the balance due prior the deadline

If you choose to pay the balance due through check or money order, you have to mail Form 941-V to the IRS. You can download Form 941-V, once you e-file Form 941 with the IRS through ExpressEfile

-

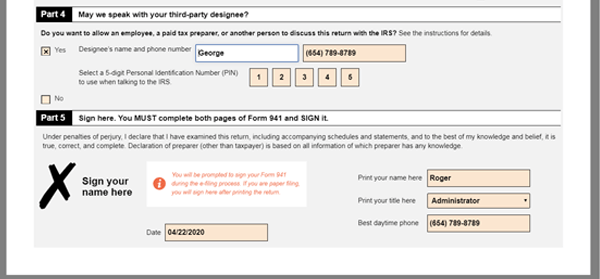

Step 3: Sign Form 941

In order to complete Form 941 online, you must sign Form 941 using Form 8453-EMP or 94x Online Signature PIN

If you have an online signature PIN you can continue to file by entering 5 digit PIN, else you can use Form 8453-EMP to sign and approve your Form 941

-

Step 4: Review & Transmit directly to IRS

The final step is to review your Form summary before transmitting it with the IRS. Our inbuilt audit check will make sure that the return is error-free to report with the IRS

You can edit any Form information if required, and if everything is fine you can transmit your return to the IRS

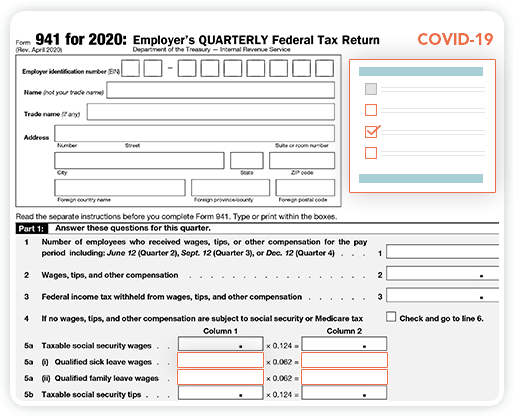

What are the COVID19 changes in IRS Form 941 for 2020?

IRS released a new Form 941, Employer’s Quarterly Federal Tax Return for 2020, and updated instructions to reflect the effects of COVID-19. The updated IRS Form 941 addresses the economic impacts of COVID-19 by allowing qualifying employers to defer deposits on their payroll taxes, apply for Payment Protection Program (PPP) loans, obtain employment tax credits, and claim payments towards advance credits. Employers will be required to use the new 2020 Form 941 when they submit their second-quarter filing to the IRS.

Click here to learn more about IRS released a new Form 941 for 2020.

Complete and File Form 941 online

Simple, Quick & Easy. It takes only less than 5 minutes.