Create Free Fillable and Printable Form 1099-MISC Online for 2019

Fill, Download & Print Forms Instantly

CREATE YOUR 1099-MISC FORMMake your tax filing easier - e-File returns to the IRS at just $1.49 / Form

Simplify Your Form 1099-MISC Online Filing with ExpressEfile!

Lowest Price

Only pay $1.49/form to

e-file your 1099-MISC with the IRS.

Form Validation

Forms will be scanned and validated for basic errors to ensure that you have transmitted your returns error-free with the IRS.

Instant Notifications

We will notify you about the filing status through the registered email once the IRS accepts your Form 1099-MISC. You can also check the status right from your account.

Mail Employee Copies

Save your time and money in sending your recipient copy. Choose ExpressEfile to mail copies to your recipient for just $1.50 per form.

What is Form 1099-MISC?

Form 1099-MISC is a tax form used to report the miscellaneous payments made to independent contractors during the tax year. Form 1099-MISC is also used to report other types of miscellaneous payments such as rents, proceeds to an attorney, fishing boat proceeds, prizes, and rewards, etc

When is Form 1099-MISC due?

Usually, Form 1099 has 3 different deadlines.

- Recipient copy Deadline - January 31st

- Paper filing Deadline - February 28th

- E-filing Deadline - March 31st

Those who report 1099-MISC for nonemployee compensation (BOX 7) must file Form 1099-MISC and should send the copy to the recipient on or before by January 31st.

What are the different copies available for Form 1099-MISC?

A Payer requires to distribute the copies of Form 1099-MISC as follows:

- Copy A—For Internal Revenue Service Center

- Copy 1—For State Tax Department

- Copy B—For Recipient

- Copy 2—To be filed with recipient's state income tax return, when required.

- Copy C—For Payer

How to complete Form 1099-MISC using ExpressEfile?

Filing your Form 1099-MISC with ExpressEfile is easy and can be done in minutes. As the deadline is fast approaching, Get Started Now and complete your filing.

Expressefile, an IRS authorized e-file provider provides the fastest way to complete your information returns such as 1099-MISC and Form W2 with the IRS.

Please follow the step by step guide to mentioned below to complete and file your Form 1099-MISC with the IRS.

-

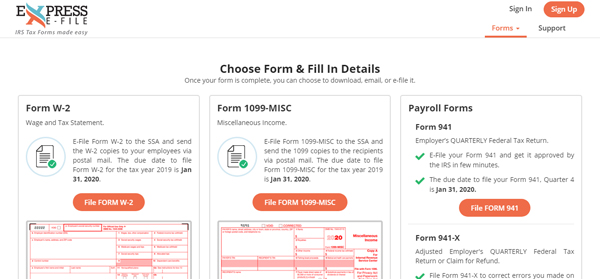

Step 1: Choose Form 1099-MISC

Choose “Form 1099-MISC” from the list of forms and continue with your filing.

Make sure you have all the information ready to complete your filing on time.

-

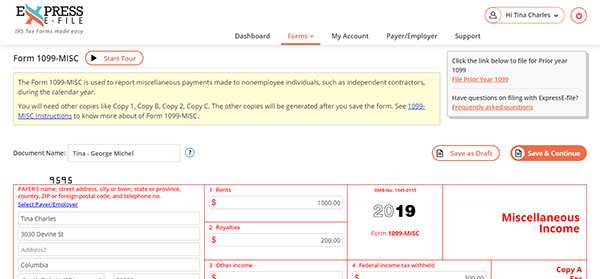

Step 2: Fill out your Form 1099-MISC

By the next step, the form will be shown and you can enter the required information one by one.

Form 1099-MISC consists of various financial information and you must take utmost care while filling out such important information.

After entering your Form 1099-MISC data, click on the “save and continue” button to proceed further.

-

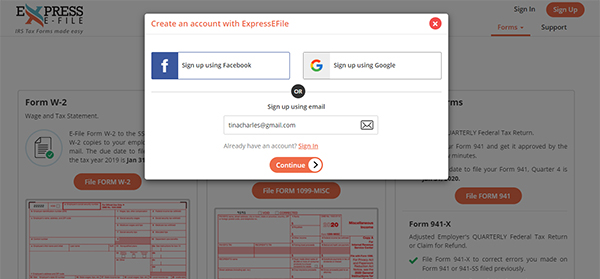

Step 3: Create an Account

- If you are a new bee, create a free ExpressEfile account to continue with your filing.

- If you had already filled with ExpressEfile, just log in to your account and continue your filing.

-

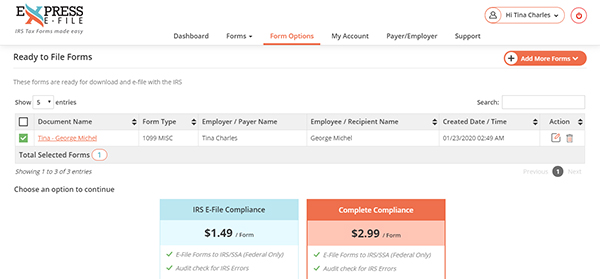

Step 4: Choose Service

ExpressEfile offers two different services “IRS E-file Compliance” and “Complete Compliance” which helps you meet your IRS filing requirements.

- “IRS E-file Compliance” - Allow you to e-file your federal Form 1099-MISC directly with the IRS directly.

- “Complete Compliance” - Allow you to e-file Form 1099-MISC with the IRS and mail the copy to your recipient on your behalf.

Choose “IRS E-file Compliance” or “Complete Compliance” as per your needs and continue with your filing.

You can download “Form 1099-MISC” in case if you are looking to handle your filing on your own for state and recipient.

-

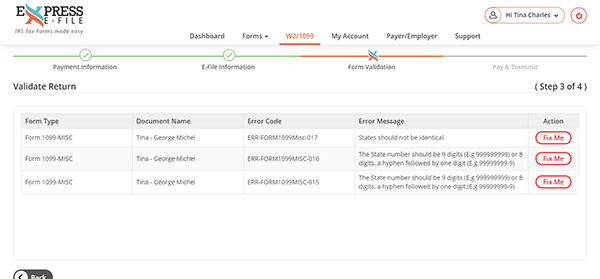

Step 5: Form validation

ExpressEfile ensures that your Form 1099-MISC is error-free to transmit by validating forms using IRS Business Rules and field-level validation. Errors identified will be notified and you will be allowed to fix it right from there.

-

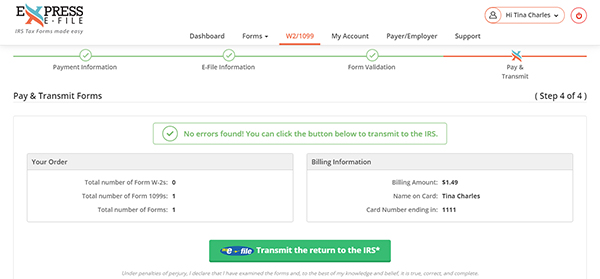

Step 6: Transmit Form 1099-MISC to the IRS

Once the Form validation is done, you can transmit your Form 1099-MISC to the IRS. You will be notified via email once the IRS processed and accepted your Form 1099-MISC. You can also check the status right from your dashboard. Still, have any questions? You can write to us at [email protected]

What is the penalty for not filing Form 1099-MISC?

IRS will impose a penalty under section 6721 for not filing form 1099-MISC by the due date. The following are the penalty.

- You will be charged a penalty of $50 per Form If you file Form 1099-MISC within 30 days of the due date.

- And, you will be charged a penalty of $100 per Form If you file Form 1099-MISC after 30 days of the due date.

Frequently Asked Questions

- How does the 1096 get filed?

- Does ExpressEFile send payee copies of Form 1099-MISC to the independent contractors?

- While filling out a 1099 misc form, you've added an account number on the form. What is this and why was it added?

- I have transmitted an incorrect 1099-MISC Form. How to make a correction?

- Does ExpressEfile support prior year tax filings for Form 1099-MISC?