Create Free Fillable 2020 Schedule B (Form 941) Online

Fill, Download, or Print Forms Instantly

Create Schedule B (Form 941) NOWEasily e-file IRS Form 941 for just $3.99 per return before the 3rd Quarter deadline on July 31, 2020.

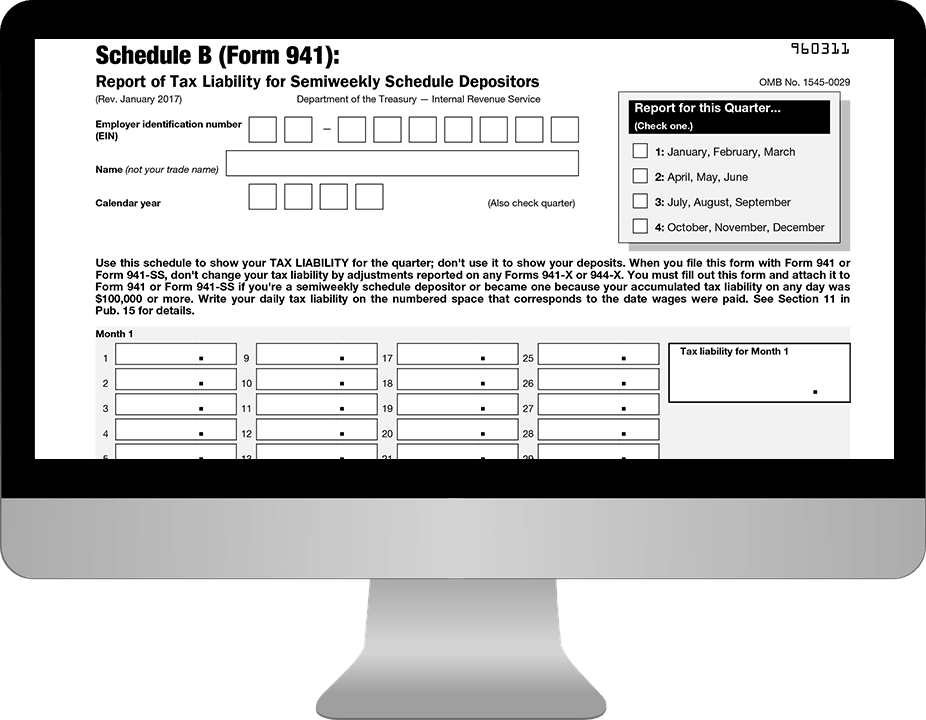

What is Form 941 Schedule B?

Form 941 Schedule B must be filed by employers along with Form 941 or 941-SS if they are a semi-weekly depositor or have accumulated $100,000 or more in tax liabilities on any given day in the current or past calendar year.

An employer is considered to be a semi-weekly depositor of federal employment taxes for the entire calendar year if the aggregate amount of taxes reported on Form 941 is more than $50,000 in the look-back period (the total amount of employment taxes reported by the employer in the 12-month period preceding June 30th).

For example, the look-back period to submit employment tax deposits in 2020 would be the 12-month period from July 1, 2018 to June 30, 2019.

How to Create Fillable Form 941 Schedule B

with ExpressEfile?

- STEP 1

While preparing your Form 941, ExpressEfile will automatically provide Schedule B if you select “You were a semiweekly schedule depositor for any part of this quarter” under Part 2 - Line 16.

- STEP 2

Enter tax liabilities for each day of the respective quarter.

- STEP 3

Schedule B (Form 941) is then generated along with your

Form 941. Upon completion, you can download copies of the form for free.

File Schedule B with Form 941 in Minutes

Upgrade from paper filing to e-filing your Form 941 along with Schedule B information in just a few clicks to the IRS

for just $3.99 per form.

It’s free!

Looking to Download Schedule B (Form 941)?

- Just fill in your Form 941 information.

- Enter Schedule B (Form 941) information.

- Download Form 941 along with Schedule B for free!