How to Create & Download Form 941-X?

Step 1

Choose Form & Fill In Details

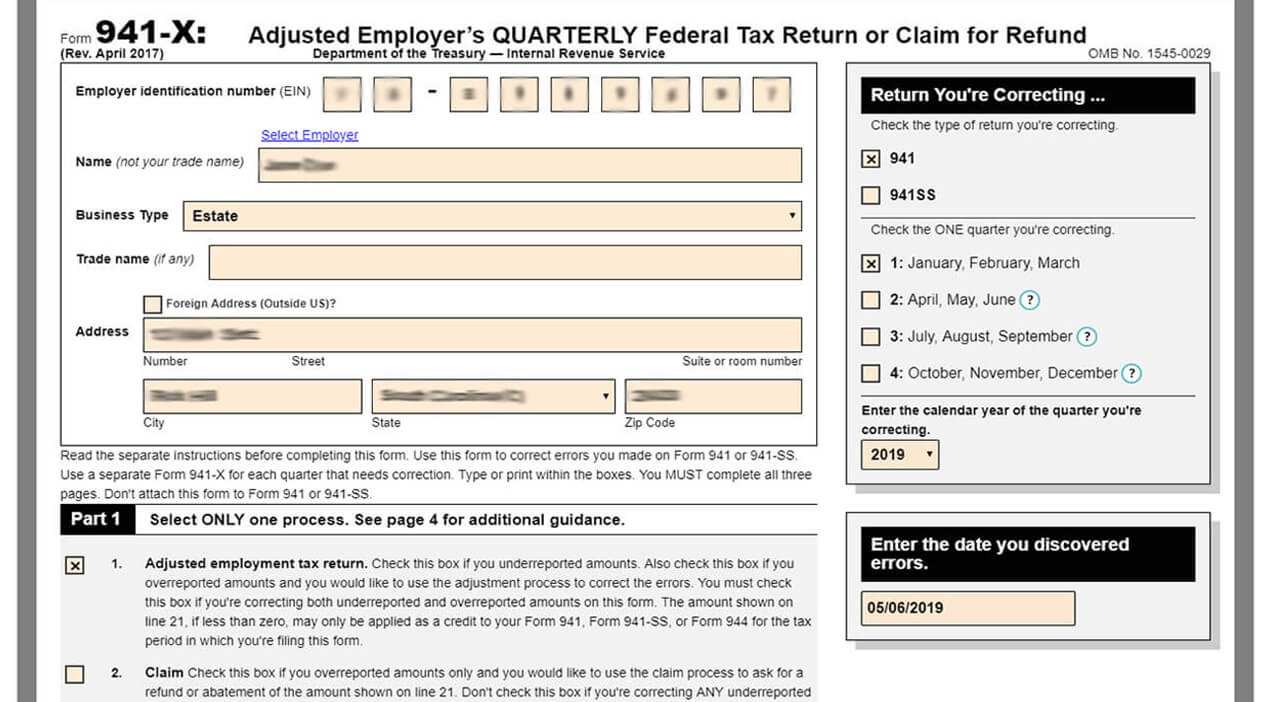

ExpressEfile allows you to generate Form 941-X for free. Simply choose "Form 941-X" and complete the required fields on the Form.

- Enter basic details about your business

- Choose the type of return (941 or 941-SS), quarter and the tax year that you are correcting for, along with the date you discovered an error on your Form.

Step 2

Completing Page 1 of Form 941-X

With ExpressEfile, you are allowed to enter Form information in each section of Form 941-X.

Part 1:

Select “Adjusted Employment Tax Return”

- If you have underreported amounts

- If you have overreported amounts and would like to correct the errors

- If you are correcting both the overreported and underreported amount on this form

Select “Claim”

- If you have overreported amounts only and would like to use the claim process for a refund or abatement of the amount.

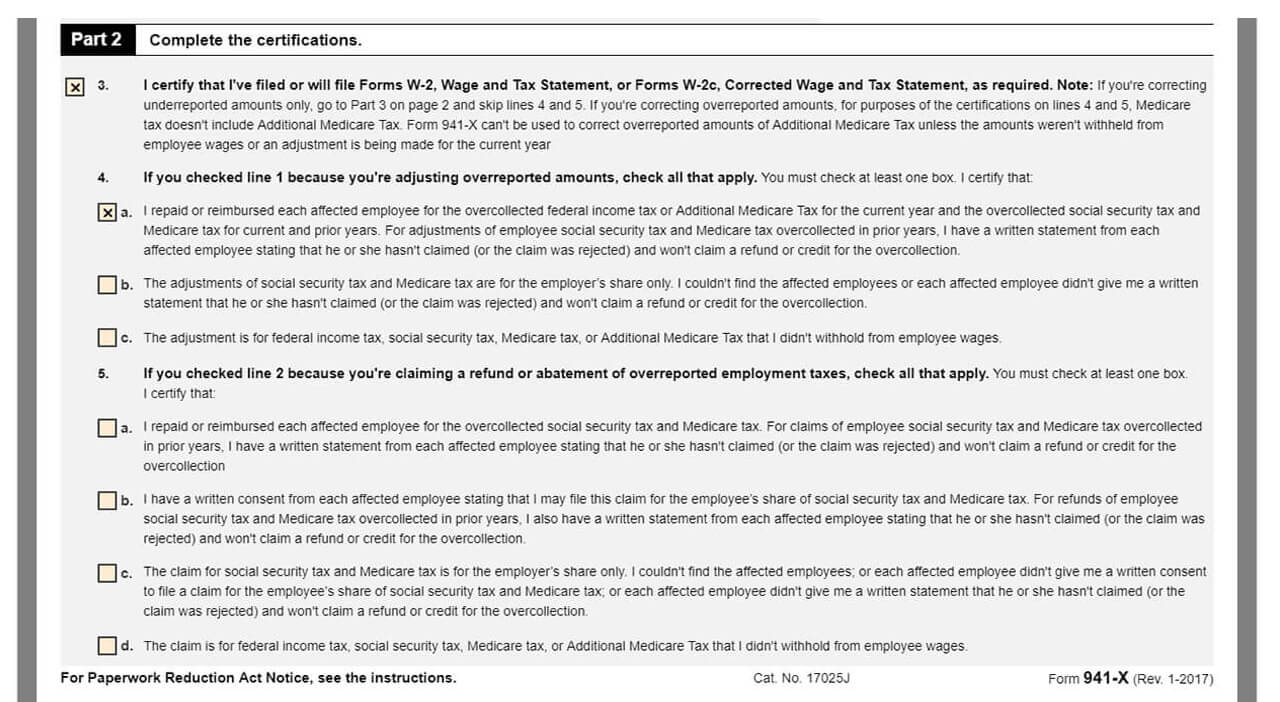

Part 2:

- If you are correcting underreported amount, just check “Line 3” and skip “Part 2” and complete “Part 3”

- If you are correcting overreported amount, check “Line 3” and check all that apply on “Line 4” and

- If you are claiming a refund or abatement for the overreported amount, check “Line 3” and check all that apply on “Line 5”

Click “Save and Continue” to proceed to page 2 of Form 941-X.

Step 3

Completing Page 2 of Form 941-X

Part 3:

- Enter the corrected amount in "Column 1" and the previously reported amount in "Column 2". Our system will auto-calculate the difference in "Column 3".

- For few lines, the amount for "Column 4" will be auto-calculated. And for a few lines, you have to enter "Column 4" values on your own.

- To simplify calculations, ExpressEfile provides a drop down value for "Lines 8-11". Select the required value per the correction that you are reporting.

- Be sure to show your calculations on "Line 24" for each line.

Click “Save and Continue” to proceed to page 3 of Form 941-X.

Step 4

Completing Page 3 of Form 941-X

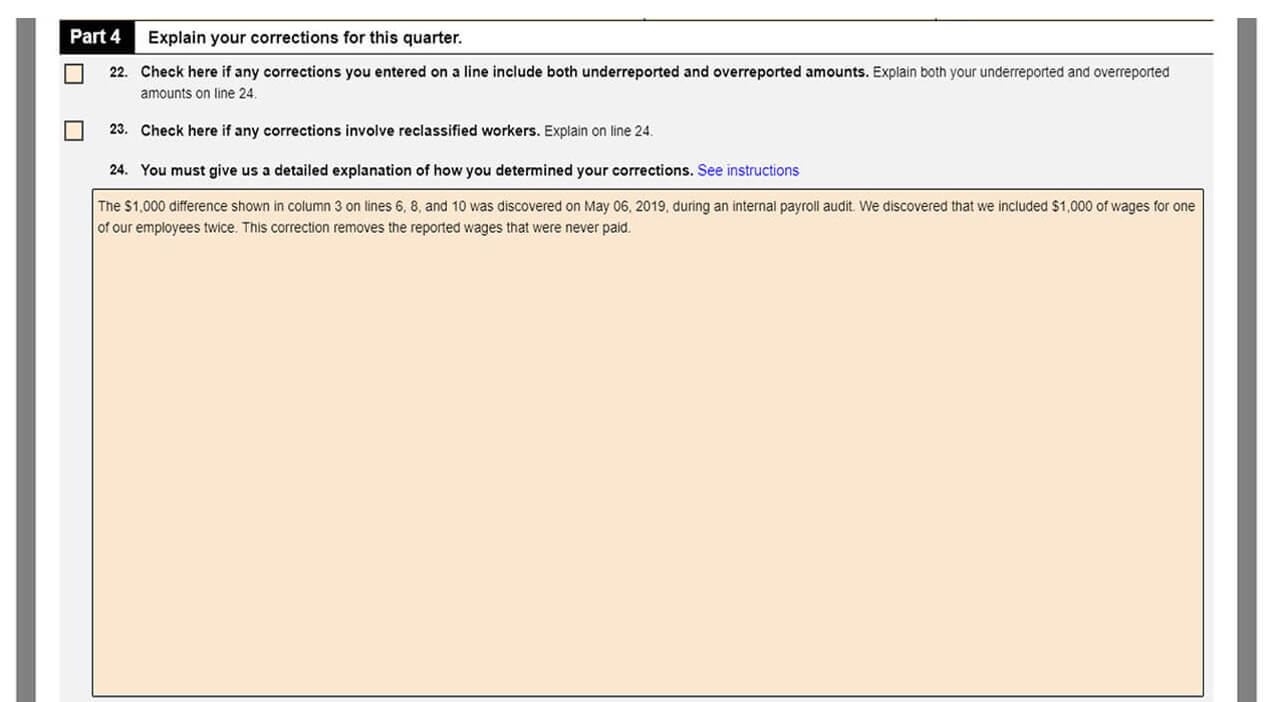

Part 4:

- If your correction includes both underreported and overreported amounts, please check “Line 22” and explain the amounts on Line 24.

- If your correction has any reclassified workers check “Line 23” and provide an explanation on "Line 24".

- Provide a detailed explanation on why are you making these corrections on "Line 24".

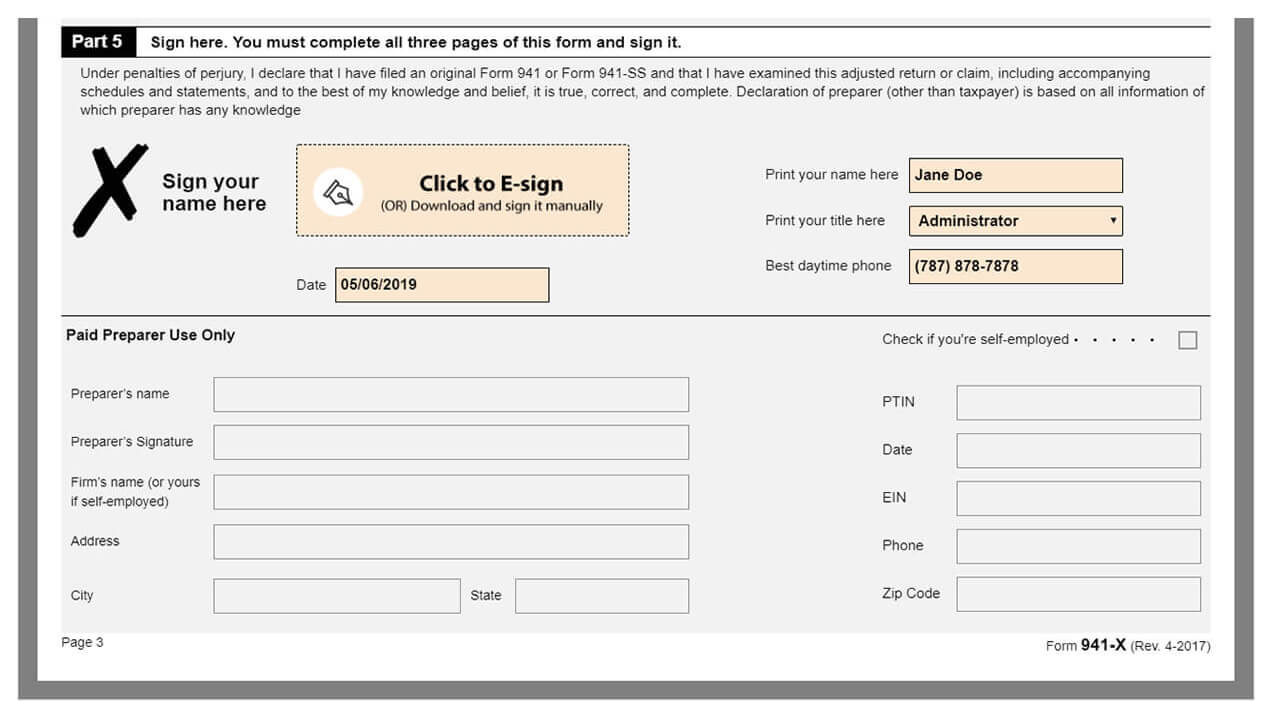

Part 5:

- You are required to sign your Form 941-X to ensure the return has been reviewed and includes all of the required statements and Schedules. You can use ExpressEfile’s convenient e-sign feature to complete this step.

- ExpressEfile allows you to attach Amended Schedule B (Form 941). Click “I will add Schedule B (Form 941),” add Schedule B information and click “Save and Continue” to proceed further or select “I do not need Schedule B.”

Click “Save and Continue” to attach Schedule B, if required.

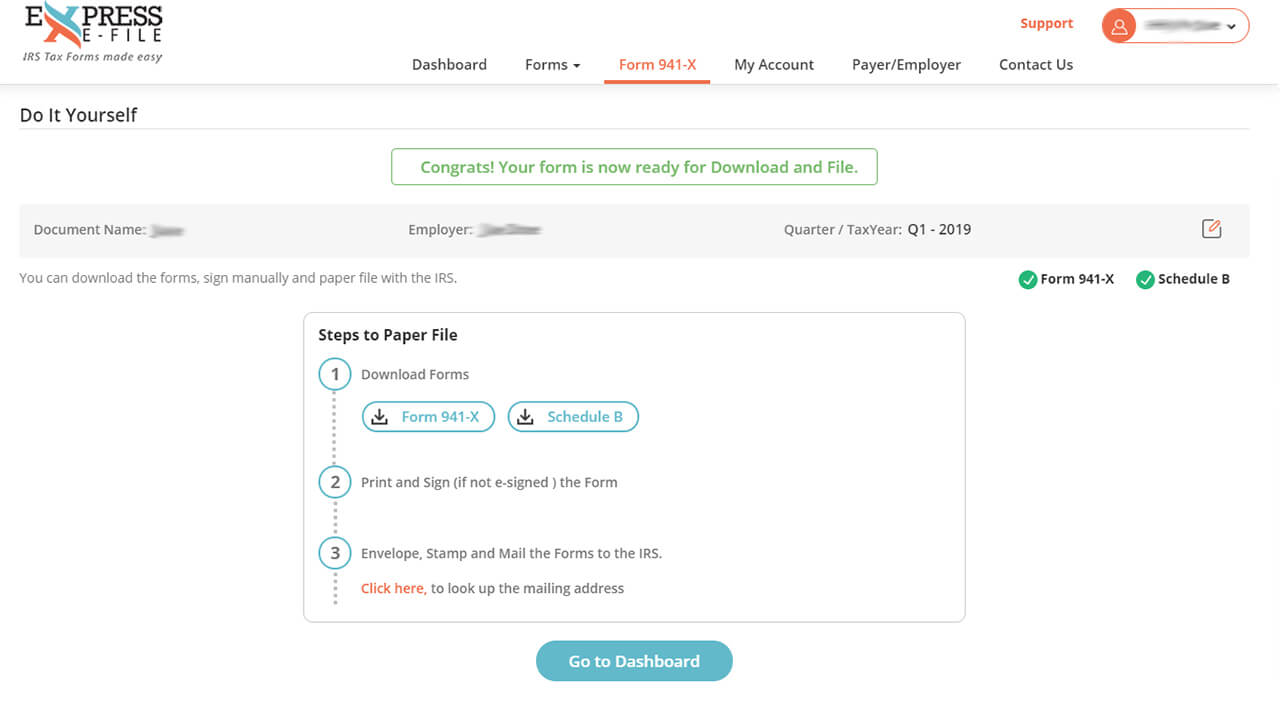

Step 5

Download, Print and Postal Mail your Form 941-X to the IRS

- ExpressEfile allows you to download Form 941-X along with Schedule B for free. Download the Form and sign if you have not used our e-sign option under “Part 5.”

- You can then print and postal mail it to the IRS on your own.